7 Insane (But True) Factors That Pull Down Your Home Value

Have questions about buying or selling a home?

Ask Now!What Can Negatively Impact Your Homes Value?

7 Factors That Are Pulling Down Your Home Value

There’s a saying that has been around since the very beginnings of capital investment:

“Buy low, sell high.”

It’s been stated so often it sounds like a cliché.

The thing about old sayings and clichés, though, is that they often contain the best advice!

When it comes to owning a home, every home buyer tries to get a good price – the desire to “buy low” comes naturally.

The same goes for home sellers who try to “sell high” – it’s a no-brainer!

But are you aware of the common home improvement pitfalls which come along and pull down your home value?

Every home seller ought to stay clear of these in order to avoid having the rug pulled out from under their great home selling price!

This is relevant to every homeowner – whether you’re planning on listing your house for sale in the immediate term, or if you are currently living in your dream home and you plan on leaving your home as part of your inheritance for your family, you want to be assured that you will be able to realise the maximum value on your property.

And, of course, this is even more pertinent for prospective home buyers!

To put yourself in the best possible position, these factors should be considered before making your initial purchase.

Whether you as the new homeowner manage to purchase the property for a steal, or if you pay top dollar for your home, it is important to remember that if you want to get a great return on your investment in the long term, it is worth considering what factors will bring your home value down!

And to make sure that (where possible) they won’t apply to you!

Here is a list of the top factors which contribute to a lower home value (some of them might surprise you!):

Unfavorable neighborhood conditions

This is a surprise to some homeowners who think that in order to ensure a high value on their property, the primary consideration to look at is the property itself.

Not quite!

There’s another old saying for you that sounds very clichéd by now, yet remains oh so true: the three L’s of selecting a property:

“Location, Location, Location”.

We have to start by not only looking at the home itself, but at the bigger picture of the neighborhood in which the home is found:

- An abundance of similar houses for sale in the neighborhood.

Are there plenty of comparable properties for sale in the neighborhood? This is a downer for your home value. This is basic economics: a high supply of similar assets (in this case, similar houses for sale), with a lower or stagnating demand, leads to lower prices. To avoid disappointment, it’s worth checking out what other houses are for sale in the neighborhood when looking to sell your house. This will give you a more realistic idea of what price range is available in your neighborhood.

- Low-quality schools in the neighborhood.

To sellers who don’t have children or who aren’t planning on growing a family in their current situation, this may come as a surprise, but this is a big deciding factor within the pool of potential buyers. If the local school has a good reputation and is well-run, your home value stands to increase. Do some research on both the primary and high schools in the area.

- The presence of city dumps, power stations, or power lines.

The sight of these is enough to put buyers off, owing to the related pollution or potential EMF radiation which may be emitted.

- The absence of good amenities in the area

If a welcoming infrastructure and/or brand name shops are lacking in the neighboring vicinity, it can be a deal-breaker for people looking for a convenient lifestyle.

- Nasty neighbors.

Whether they are of the “messy” or “noisy” variety, these nightmare neighbors are more than inconsiderate – they’re harmful to your home value!

- Crime and urban decay.

If the general state of the neighborhood is slipping, there’s no doubt that the home value of the properties will slide as well.

If you are looking to sell, there is only so much you can do about your neighborhood – but there are some things you can do!

For example, you can be a positive change to your local school through volunteering support. Neighbourhood watches and community policing forums have had some real impact into certain suburbs. Look for opportunities where you can make a difference – you might be surprised at what change can do, especially if you build a team of like-minded homeowners.

Alternatively, if you are looking to buy – remember to factor the location heavily into the decision-making process.

It is helpful to look at a new property not only through the eyes of a buyer, but also to consider how readily you might be able to sell at a later stage, based on these concerns, when you are making the decision to invest in a home.

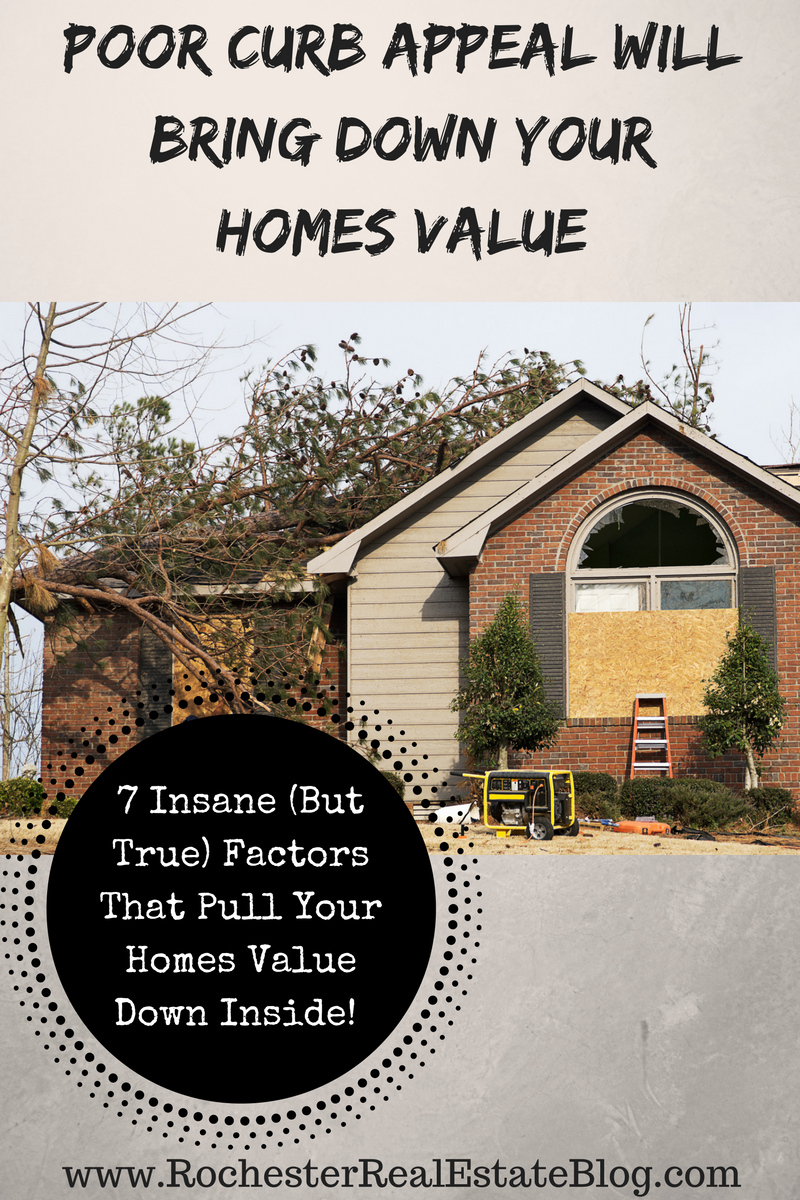

Lack of curb appeal = Curb repulsion!

Poor Curb Appeal Will Bring Down Your Homes Value

This second point brings us closer to the home itself – but we’re not going inside just yet!

Take a look at the state of the roadside pavement, driveway, exterior walls or fencing, and the garden or yard area.

As a general rule, a well-maintained exterior leads to a higher home value, while a run-down appearance, unkempt flora with peeling paint, rust, and/or cracked walls can cause valuators to mark down the home value in a blink!

The good news for prospective home sellers is that this might be something you have more direct control over than the broader factors of the neighborhood in which your property stands.

Investing in a fresh coat of paint and a few hours’ worth of garden service can result in a very positive return.

Let’s stick with the exterior of the house for a moment: it is helpful to remember that many buyers are interested in garage space, as well as garden space, and without these, the home value is likely to be diminished.

Therefore, it is wise to carefully consider before performing renovations which kill garden space and garage space, for example adding a sitting room on a corner of the garden, or converting a double garage into a single plus an extra study.

Not all buyers would approve!

Swimming pools can be unattractive to buyers due to their high upkeep, and so in certain instances, the addition of a pool can cause a dip in home value rather than an increase! This is especially true in certain geographic areas with cooler climates.

Interior aesthetics

At last, we move inside the house!

The major consideration here is facilitating a sense of spaciousness!

Cramped quarters and tight spaces in the kitchen, lack of space for multiple appliances like fridges, washing machines, and dishwashers – all these will bring that home value down.

Consider creating a sense of space in the home through a good arrangement of furniture, and more drastically, through renovations if possible. The trend one may have noticed in recent years has been to take 1970’s-style architecture in established suburbs, and to break open the tight areas, turning a cramped 7-room house into an airy, spacious 5-room house with an open-plan kitchen and living area, for example.

The other advantage of this is that it brings in natural light, which home buyers love.

Another consideration is the interior decoration.

Something as simple as the choice of wallpaper and paint colors can have adverse effects on the value of the home. As a general rule, sellers should keep these choices generally accessible and more neutral, rather than quirky or extreme.

Eccentric fittings and fixtures can be replaced with attractive yet simple pieces to increase interest, thereby increasing overall home value!

Outstanding home repairs

Sagging roof? Your valuation will start to sag.

Busted plumbing? House value’s slipping down the drain.

Exposed wiring? You’re in for a shock.

What hurts more than terrible puns? A less-than-impressive home value for you as the seller.

It is in the seller’s own interest to sit down and strategize around how to tackle these kinds of repairs before valuation and listing!

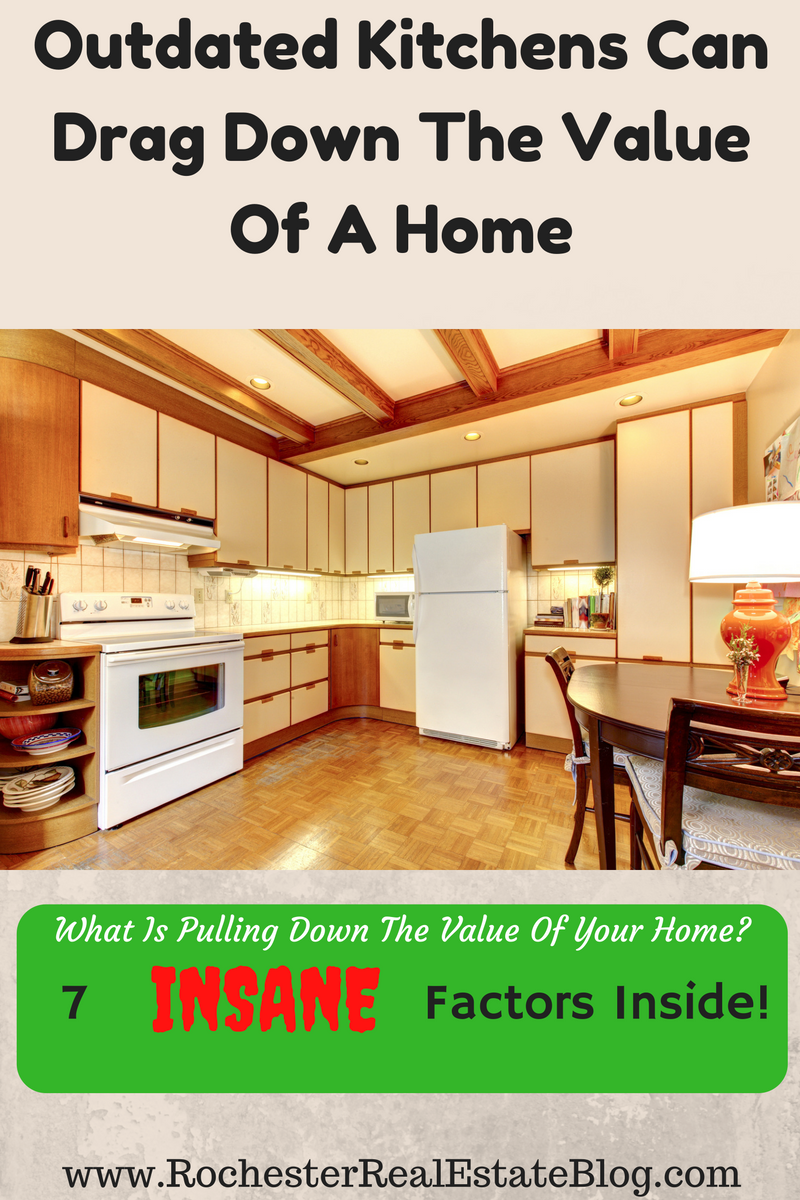

A sub-standard kitchen

Outdated Kitchens Can Drag Down The Value Of A Home

A house can have the most amazing lounge, bedroom and living area, but still fail to impress in the valuation if the kitchen is dingy, dated or dirty.

It is worth far more to have a great kitchen than having just about any other part of the house looking magnificent!

If you have a choice of renovating the kitchen or another part of the house, chances are you will have a greater return on investment if you put some work into the kitchen.

It’s not a case of acquiring all the mod-cons and extravagant fittings and tiles – rather consider some quality, contemporary counter space and cupboards.

Ensure the stove and oven are working and looking good. Consider the state of the tiles on the floor and the splash-back on the wall behind the stove.

And don’t forget the previous point about outstanding repairs!

If you as a seller take this list as a whole, and you have some budget for renovation before having your house valuated, it is probably a good idea to make it your top priority to sort out any outstanding home repairs here in the kitchen.

Out of this world bathroom

Yes, you read it right!

An outstanding bathroom, with all the bells and whistles, can actually bring your home value down!?

How is this possible, you ask?

It often happens when the fixtures, fittings and mirror frames are extremely ornate and over-the-top.

If the bathroom is too “customized” into a very specific taste or style, it is difficult for buyers from all walks of life to immediately appreciate the style of the bathroom – even if the seller considers his or her expensive bathroom renovation impeccable.

Here is a key that will set you up for success: home buyers don’t want to be reminded of the previous owners.

That’s the reality of it!

The new homeowners want to move in and make the space their own as quickly as possible.

So, if you are renovating and you plan on selling in the short-to-medium-term, it is always advisable to choose good-quality, but more stylistically standard fixtures.

Otherwise, you may have a nasty surprise when your home value reflects a smaller increase in value than the actual cost of the renovation itself!

Unhelpful tenants

The last point on our list applies to owners with tenants renting their homes.

The wrong tenants in your house can diminish the overall home value through ill-treatment of the premises.

There are quite a number of things you can do to avoid this unfortunate situation:

Use a reputable tenant placement agency if you can afford it. It is absolutely essential to have a proper rental agreement in place in any case which gives you some recourse as the homeowner in the event of damages and other problems which may arise.

Be sure to interview prospective tenants so you can begin to get to know them. And be sure to get references and credit checks before signing the contract.

By tackling the items on the above list, it is possible for your home value to easily gain a few percentages!

Check them off and face your home valuation with a smile!

Other Resources Relating Home Values

- How Do Home Improvement Projects Impact A Homes Value? via Behance

- What Home Improvements Lower A Homes Value via Storify by Bill Gassett

- Budget Friendly Home Improvement Projects via Teresa Cowart

About the author: The above article was provided by Xavier De Buck, your top-producing Northcliff (Johannesburg) real estate agent, who’s passionate about the property market, technology and the synergy of both! You can read his blog at NorthcliffRealEstate.com.

About Rochester’s Real Estate Blog: The above article “7 Insane (But True) Factors That Pull Down Your Home Value” is hosted on Rochester’s Real Estate Blog which is run by the Keith Hiscock Sold Team (Keith & Kyle Hiscock). With over 30 years combined experience, if you’re thinking of selling or buying, we’d love to share our knowledge and show why we’re considered one of the best real estate teams in Rochester NY!

We service the following Greater Rochester NY areas: Irondequoit, Webster, Penfield, Pittsford, Fairport, Brighton, Greece, Gates, Hilton, Brockport, Mendon, Henrietta, Perinton, Churchville, Scottsville, East Rochester, Rush, Honeoye Falls, Chili, and Victor NY.